闇に流れる拳銃の多さーアトランタ犯罪レポート 1月24日(金)

Veinte quatro de Enero(Vieres)

先日の車盗難未遂の犯人がEast Pointで捕まったそうです、5人組です。まあ最低10年は出てこれないでしょう。

昨年1年にCity Of Atlanta内でどれだけの拳銃が盗難に遭っているか知っていますか? 1千丁を超えるそうです。単純に毎年1千丁の拳銃が犯罪組織に流れていることになります。

これがメトロアトランタのすべての市で計算すると、概算で2倍、2千丁の拳銃が毎年消えていることになる。

さらには軍隊からも拳銃などの火器が消えていますから(まあ横流しされていると推測)、アメリカから銃がなくなることはなく、犯罪にどんどん使われることになります。

今週日曜日です

今週日曜日です

アトランタ対ワシントン。しかし八村塁は出るのか? 多くのアトランタ在住の日本人が日ごろはバスケに興味もないのに、塁見たさにチケットを買い、肝心な塁が故障中で出ない??? 金返せ、ゲーム見ても仕方ない。詐欺だ!と感じているのでは?

ちなみに今季のこれまでの成績があります。アトランタは東地区ですが、最下位で、11勝34敗。ワシントンが11位で15勝29敗です。全部で15チームあるのですが、1位はミルウォーキーで39勝6敗とダントツの1位。

西地区ではLAレーカーズがこれまた39勝6敗で1位。意外にも最下位はサンフランシスコで10勝36敗、これは主力が故障しているからでしょう。

塁は年末に相手が原因?で怪我をして手術を受けたという報告もありますが、1月4日のゲームにはコート入りしています。これが3週間ぶりのこと。

その記事によると、今月半ばまではベンチに座る予定で、その後の診断で試合に出るということなので、場合によっては出る可能性もありそうですが、ギリギリの選択肢になりそうです。

リタイヤするときにすること

手元に十分なお金があるか再確認する

手元に十分なお金があるか再確認する

お金の使い道を真剣に考える

お金の使い道を真剣に考える

市場が下げたときにどう対処するか考える

市場が下げたときにどう対処するか考える

ソーシャルセキュリティをいつ申請するか考える

ソーシャルセキュリティをいつ申請するか考える

FRA-フル・リタイアメント・エイジは67歳ですが、63歳から申請できます、しかしこれは生涯手取りを30%減少させます。そして70歳から受けとることもできます、これだと障害手取りが24%増えるそうです。

しかし、ここはギャンブル?仮に68歳で死んでしまえば、減少も増加もあったもんではありません。

ヘルスケアのコストを考える、平均1年に4300ドル必要

ヘルスケアのコストを考える、平均1年に4300ドル必要

長期療養コストを考える。70%のシニアは最終的にこうなっている。自宅で毎日介護されると月額6800ドルが必要という試算あり

長期療養コストを考える。70%のシニアは最終的にこうなっている。自宅で毎日介護されると月額6800ドルが必要という試算あり

資産の見直しをする、遺言の書き換えとか

資産の見直しをする、遺言の書き換えとか

住宅コストを考える、大抵の人は引退後、小さな家に住む

住宅コストを考える、大抵の人は引退後、小さな家に住む

運動、趣味と実益を兼ねてパートタイムの仕事を考える

運動、趣味と実益を兼ねてパートタイムの仕事を考える

IRAやSSの税金を考える、収入=税金で各州により異なる

IRAやSSの税金を考える、収入=税金で各州により異なる

引退したからといって、貯蓄を止めないこと。

引退したからといって、貯蓄を止めないこと。

3-6, 4-6 とまあストレートで負けましたね。大坂なおみ。メンタルがやはり問題なのでは?

今の売れ筋は「シグマ2アンサー」だそうです。在庫が足りなくて数カ月待ちなのだそうです。渋野効果です、ピンは大喜びしています。

定価は22400円です。

国債残高1063兆円。増え続けます。この数字は2029年にこうなるという推測ですが、現在900兆3700億円です。これからも老人が増えるので財政支出は増えるだけ、借金も増えるのです。対策は何もありません。「みんなで赤字を出せば怖くない」

医療費カットしますか? 死ぬ権利も大事にしよう。寝たきり制度反対! 良い状態で死なせてあげよう。次の世界があるのだから! 元気に死のう! 自分の最期は自分で決めよう! マジでそう思うのです。病院のベッドで死ぬのは良くない。

先日の車盗難未遂の犯人がEast Pointで捕まったそうです、5人組です。まあ最低10年は出てこれないでしょう。

昨年1年にCity Of Atlanta内でどれだけの拳銃が盗難に遭っているか知っていますか? 1千丁を超えるそうです。単純に毎年1千丁の拳銃が犯罪組織に流れていることになります。

これがメトロアトランタのすべての市で計算すると、概算で2倍、2千丁の拳銃が毎年消えていることになる。

さらには軍隊からも拳銃などの火器が消えていますから(まあ横流しされていると推測)、アメリカから銃がなくなることはなく、犯罪にどんどん使われることになります。

今週日曜日です

今週日曜日ですアトランタ対ワシントン。しかし八村塁は出るのか? 多くのアトランタ在住の日本人が日ごろはバスケに興味もないのに、塁見たさにチケットを買い、肝心な塁が故障中で出ない??? 金返せ、ゲーム見ても仕方ない。詐欺だ!と感じているのでは?

ちなみに今季のこれまでの成績があります。アトランタは東地区ですが、最下位で、11勝34敗。ワシントンが11位で15勝29敗です。全部で15チームあるのですが、1位はミルウォーキーで39勝6敗とダントツの1位。

西地区ではLAレーカーズがこれまた39勝6敗で1位。意外にも最下位はサンフランシスコで10勝36敗、これは主力が故障しているからでしょう。

塁は年末に相手が原因?で怪我をして手術を受けたという報告もありますが、1月4日のゲームにはコート入りしています。これが3週間ぶりのこと。

その記事によると、今月半ばまではベンチに座る予定で、その後の診断で試合に出るということなので、場合によっては出る可能性もありそうですが、ギリギリの選択肢になりそうです。

リタイヤするときにすること

手元に十分なお金があるか再確認する

手元に十分なお金があるか再確認する お金の使い道を真剣に考える

お金の使い道を真剣に考える 市場が下げたときにどう対処するか考える

市場が下げたときにどう対処するか考える ソーシャルセキュリティをいつ申請するか考える

ソーシャルセキュリティをいつ申請するか考えるFRA-フル・リタイアメント・エイジは67歳ですが、63歳から申請できます、しかしこれは生涯手取りを30%減少させます。そして70歳から受けとることもできます、これだと障害手取りが24%増えるそうです。

しかし、ここはギャンブル?仮に68歳で死んでしまえば、減少も増加もあったもんではありません。

ヘルスケアのコストを考える、平均1年に4300ドル必要

ヘルスケアのコストを考える、平均1年に4300ドル必要 長期療養コストを考える。70%のシニアは最終的にこうなっている。自宅で毎日介護されると月額6800ドルが必要という試算あり

長期療養コストを考える。70%のシニアは最終的にこうなっている。自宅で毎日介護されると月額6800ドルが必要という試算あり 資産の見直しをする、遺言の書き換えとか

資産の見直しをする、遺言の書き換えとか 住宅コストを考える、大抵の人は引退後、小さな家に住む

住宅コストを考える、大抵の人は引退後、小さな家に住む 運動、趣味と実益を兼ねてパートタイムの仕事を考える

運動、趣味と実益を兼ねてパートタイムの仕事を考える IRAやSSの税金を考える、収入=税金で各州により異なる

IRAやSSの税金を考える、収入=税金で各州により異なる 引退したからといって、貯蓄を止めないこと。

引退したからといって、貯蓄を止めないこと。3-6, 4-6 とまあストレートで負けましたね。大坂なおみ。メンタルがやはり問題なのでは?

今の売れ筋は「シグマ2アンサー」だそうです。在庫が足りなくて数カ月待ちなのだそうです。渋野効果です、ピンは大喜びしています。

定価は22400円です。

国債残高1063兆円。増え続けます。この数字は2029年にこうなるという推測ですが、現在900兆3700億円です。これからも老人が増えるので財政支出は増えるだけ、借金も増えるのです。対策は何もありません。「みんなで赤字を出せば怖くない」

医療費カットしますか? 死ぬ権利も大事にしよう。寝たきり制度反対! 良い状態で死なせてあげよう。次の世界があるのだから! 元気に死のう! 自分の最期は自分で決めよう! マジでそう思うのです。病院のベッドで死ぬのは良くない。

アトランタのTVのホームページの1面を飾っています。昨年の女王を破ったと。

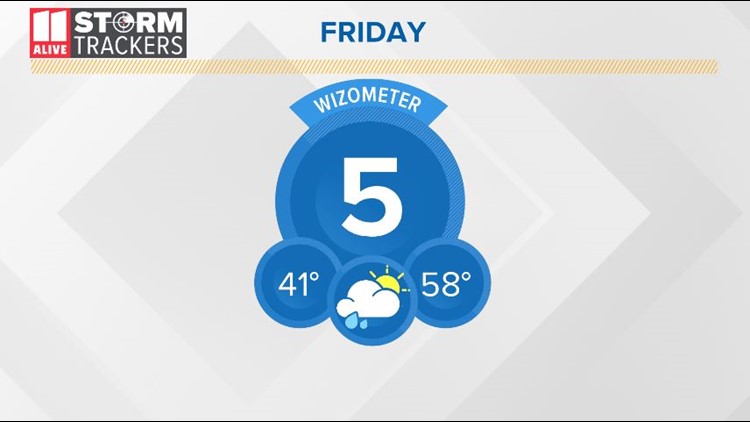

雨は午後には上がります。夕方のディナーの雨は避けられそうです。

2日連続の暇から一転、来るわ来るわ、一時は満席でした。読めないビジネスです。お陰様で今月もUPしています。これで3カ月連続のUPは確定かと思います。

昨日も赤ワインを3本売りました。40ドルと25ドルが2本ですけどね。その25ドルはQuiltというカベルネで、先週確かCaymusを2本買ったお客さんがまた買ってくれました。

QuiltはKrogerだと35ドルから40ドルします。うちの方が断然安いのです。Sandy Springsのお客さんはこのあたりに弱いかと。店ではカベルネ飲まないが、家で肉にカベルネ? そして安い値打ちのあるワインなら買いたい。そこを攻めていくのが常道ではないかと。どこかでワイン買うならTAKAで買わせる、その値段に落とす。

三菱がまた飛行機の納入時期を延ばしました、6回目だそうです。7回伸ばしても良いですよ、とにかく諦めるな。国策でいけ! 認証が取れて製造が始まると、どれだけの仕事が国内に回ってくるか?

自動車は電気自動車になれば、国内の仕事も減っていくのです、部品点数が減りますからね、確か3割減。ということは今後30%の仕事は減っていく。それを埋めるのが飛行機の製造であれば、最高ではないですか? 頑張れ日の丸飛行隊!皆さん、良い週末を!

Comments