ゴマだけにセサミン? 8月29日(木)

Veinte nueve de Agost (Jueves)

「暇な時はお客さんに奉仕せえ」それが私のいつもの行動です。滞在時間を伸ばしてもらいます。

1)バーに座っていたカップル、食事が終わり、話中、でもワイングラスは空。そこに半分注いであげる。ちょうど、そのワインは瓶に少しだけ残っていたので、それを提供。するとあとで1杯またオーダーしてくれた。

2)いつも寿司バーに座る若いカップル、姉ちゃんはロゼの虜で、Stillかスパークリングなのか分からないが3-4杯は飲む。昨夜はStillだったので、閉めにスパークリングを差し出す。男性はTitoにGFジュース。先日入ったいいちこの採天を飲めと、これも提供する。

3)同じ寿司バーのおまかせ常連さん、昨日は梅酢にコンブチャで、「健康に良いから飲め」と出す。これで話を作る。

従業員にはいつも言っていることですけどね、そこまで気が利いて、お客さんに注ぎに行く人はいなから、オーナー自らやるのですよ。まあ、それが一番効果があります。少しの奉仕がやがて実ることもあります。

フードもそうで、たまに自分で運んで説明してあげると、喜ばれるものです。店への思い、商品への思いが、そりゃ違いますからね、自分で作ったものを自分で運び、説明まですれば、喜ばれます。

私は「小さな巨人」と呼んでいます。里中(ドカベンの)ではありません。ゴマです、ここからが本題。 ゴマは英語でセサミシード、でその栄養素がセサミン。

今夜はこれ!

今夜はこれ!

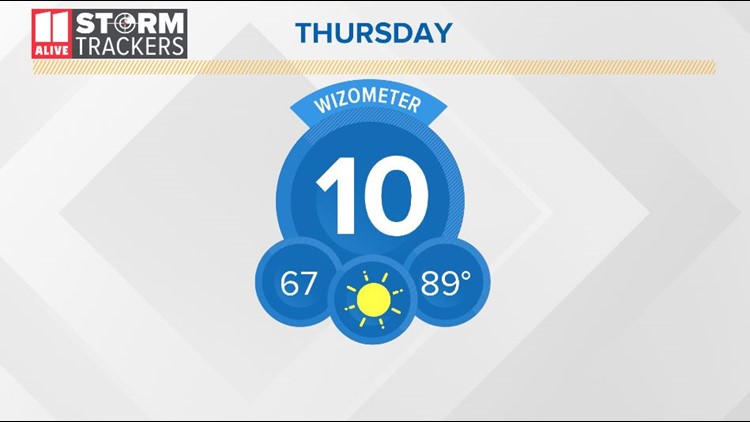

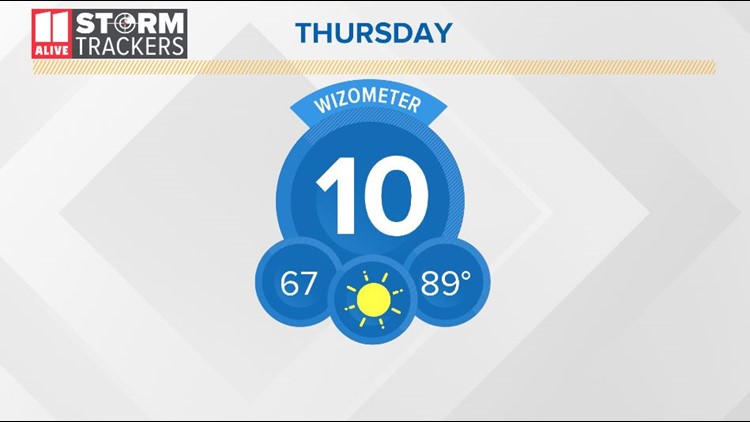

ドリアンはフロリダの東岸に行くと思われますが、上陸直線カテゴリー3を維持、上陸して1に代わるという予測です。

ドリアンはフロリダの東岸に行くと思われますが、上陸直線カテゴリー3を維持、上陸して1に代わるという予測です。

孫にたくさんのギフトを買う

孫にたくさんのギフトを買う

大人になった子供の面倒を見続ける

大人になった子供の面倒を見続ける

図書館などを利用しないで買う

図書館などを利用しないで買う

シニア割引をあまり利用しない

シニア割引をあまり利用しない

バーゲンに弱い

バーゲンに弱い

生命保険に上手くお金を払っていない

生命保険に上手くお金を払っていない

大きな家に住み続ける

大きな家に住み続ける

旅行にお金を使い過ぎ

旅行にお金を使い過ぎ

SSの早期受け取り

SSの早期受け取り

ムダ金を使う、ギャンブルでは儲からないんだよ!

ムダ金を使う、ギャンブルでは儲からないんだよ!

老夫婦に車2台は不要、1台に絞るべし

老夫婦に車2台は不要、1台に絞るべし

薬をジェネリックにすべし、安いので

薬をジェネリックにすべし、安いので

無駄な医療費を使う、テストなどで

無駄な医療費を使う、テストなどで

スマホなどを巧く使う、無駄なことはしない

スマホなどを巧く使う、無駄なことはしない

65歳になったらメディケアを申請する

65歳になったらメディケアを申請する

タイムシェアなどのバケーションプランを買わない

タイムシェアなどのバケーションプランを買わない

年金積立の引き出しをペナルティなしに行う

年金積立の引き出しをペナルティなしに行う

「暇な時はお客さんに奉仕せえ」それが私のいつもの行動です。滞在時間を伸ばしてもらいます。

1)バーに座っていたカップル、食事が終わり、話中、でもワイングラスは空。そこに半分注いであげる。ちょうど、そのワインは瓶に少しだけ残っていたので、それを提供。するとあとで1杯またオーダーしてくれた。

2)いつも寿司バーに座る若いカップル、姉ちゃんはロゼの虜で、Stillかスパークリングなのか分からないが3-4杯は飲む。昨夜はStillだったので、閉めにスパークリングを差し出す。男性はTitoにGFジュース。先日入ったいいちこの採天を飲めと、これも提供する。

3)同じ寿司バーのおまかせ常連さん、昨日は梅酢にコンブチャで、「健康に良いから飲め」と出す。これで話を作る。

従業員にはいつも言っていることですけどね、そこまで気が利いて、お客さんに注ぎに行く人はいなから、オーナー自らやるのですよ。まあ、それが一番効果があります。少しの奉仕がやがて実ることもあります。

フードもそうで、たまに自分で運んで説明してあげると、喜ばれるものです。店への思い、商品への思いが、そりゃ違いますからね、自分で作ったものを自分で運び、説明まですれば、喜ばれます。

私は「小さな巨人」と呼んでいます。里中(ドカベンの)ではありません。ゴマです、ここからが本題。 ゴマは英語でセサミシード、でその栄養素がセサミン。

これがゴマのパワーです。じゃ、ゴマを食べようと思っても、皮に覆われていて、下手したら吸収どころか、そのまま便で流れ出てしまいます。

ではどうするか? 擂るしかないのです。ゴマをそのまま食べるよりも摺りごまにして、使う。

最近、畑で十六ささげがたくさん採れるので、それを茹でて、豆腐の水気を取り、白和えにし、そこに摺りごまを加えています。味噌も少し入れて調整。こうすればセサミンが摂取できるわけです。

今夜はこれ!

今夜はこれ!

昨年の覇者、クレムゾン対GAテックのオープニングゲームがあります。これは今夜のビジネスに大きな影響を与えそうです。

ドリアンはフロリダの東岸に行くと思われますが、上陸直線カテゴリー3を維持、上陸して1に代わるという予測です。

ドリアンはフロリダの東岸に行くと思われますが、上陸直線カテゴリー3を維持、上陸して1に代わるという予測です。

引退した人が陥りそうな罠

孫にたくさんのギフトを買う

孫にたくさんのギフトを買う 大人になった子供の面倒を見続ける

大人になった子供の面倒を見続ける 図書館などを利用しないで買う

図書館などを利用しないで買う シニア割引をあまり利用しない

シニア割引をあまり利用しない バーゲンに弱い

バーゲンに弱い 生命保険に上手くお金を払っていない

生命保険に上手くお金を払っていない 大きな家に住み続ける

大きな家に住み続ける 旅行にお金を使い過ぎ

旅行にお金を使い過ぎ SSの早期受け取り

SSの早期受け取り ムダ金を使う、ギャンブルでは儲からないんだよ!

ムダ金を使う、ギャンブルでは儲からないんだよ! 老夫婦に車2台は不要、1台に絞るべし

老夫婦に車2台は不要、1台に絞るべし 薬をジェネリックにすべし、安いので

薬をジェネリックにすべし、安いので 無駄な医療費を使う、テストなどで

無駄な医療費を使う、テストなどで スマホなどを巧く使う、無駄なことはしない

スマホなどを巧く使う、無駄なことはしない 65歳になったらメディケアを申請する

65歳になったらメディケアを申請する タイムシェアなどのバケーションプランを買わない

タイムシェアなどのバケーションプランを買わない 年金積立の引き出しをペナルティなしに行う

年金積立の引き出しをペナルティなしに行う

これらはなかなか的を得ていると思います。引退して多くの人は収入がなくなるわけで、年金だけが収入の人が大半です。そのお金を有効に使わないと生活が成立しなくなります。

本日は晴天なり! 週末のアトランタは忙しい。毎年恒例のドラコンコンテストがあり、学生フットボウルの開幕、そしてプロも開幕します。

連日の日韓関係の報道、誰が儲かるのか? そりゃ、テレビで出てくる解説者でしょう。元韓国大使の武藤さん、辺真一さんなど、韓国情勢に詳しい専門家が多い。

で、何を話すのか? 行動の読めない文? 断絶してもいいのでは? 日本は韓国なしでも生きていけますからね、「この恩知らずめが」としか私は思えないのでね。

悪いことばかりを取り上げ、「日本は復興に協力してくれたんや」と、そんな報道が一切ない。独立して出ていったバカ息子がお金ないから親にせびりに来ているようなもんですよ。いつまでせびるのか?

Comments